Texas property taxes are a concern when home values are increasing quickly. While they are calculated by multiplying the home's assessed value by the tax rate. The assessed value is typically lower than the home's market value, and there are a number of homestead exemptions that can further reduce the assessed value. This provides a property tax shock absorber that prevents increases that might make homes unaffordable.

Homeowners often make four mistakes when estimating their property taxes:

- Estimating taxes using total market value instead of assessed value

- Not understanding how homestead exemptions reduce assessed value

- Not understanding the 10% annual limit on increase on assessed value

- Not filing for homestead exemptions

This blog post provides more detailed information on these topics, real-life examples, and updates for 2024.

Property Tax Concerns

This article is for the person who says, “I really don’t understand how property taxes are calculated or what I can do about it.”

To help provide some clarity this post will explain this in six steps.

- Property Tax Basics

- Four Common Mistakes

- Real-Life Examples

- Why Home Prices Keep Going Up

- Texas Property Taxes

- Solutions for Seniors

Property Tax Basics

Many Texas homeowners get upset when they receive their Notice of Appraised Value from the Central Appraisal District. They look at the Total Market Value and say something like, “Are they crazy? How do they come up with such a big number? My house is not worth that.” They fear they won’t be able to stay in their home because property taxes will blow up their budget.

When people go to the county appraisal district website, look up their property, and see an eye-popping number for Total Appraised Value. They often look at the bottom of the form, see (last year’s) Tax Rate, multiply the new Total Market Value by the tax rate and (erroneously) assume they are doomed.

Fortunately, once homeowners understand the basics and the 4 Common Mistakes we’ll cover below, they feel better.

How Property Taxes Work

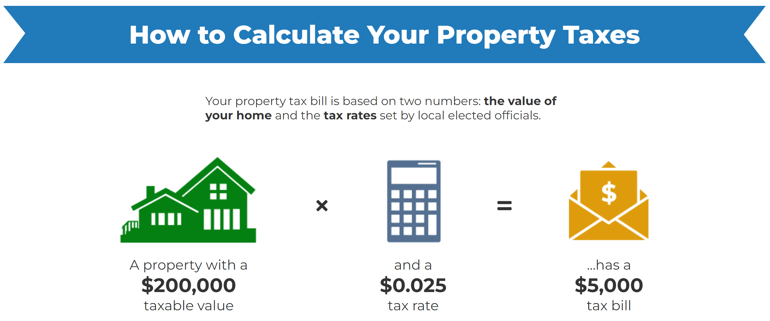

House Value x Tax Rate = Property Tax

If a house is worth $200,000 and the tax rate is 2.5% (0.025), the annual property tax is $5,000 (200,000 x 0.025) per year. If the value of the house goes up, the property tax will go up.(1)

How Property Tax Rates Are Determined

In simple language, property taxes are set to total the financial needs of all entities (cities, counties, schools, etc.) that rely on those taxes for their funding.

One reason property taxes seem complicated is because every property is taxed by multiple entities. Homes in different counties and cities can be taxed by any, or all, of the following taxing entities:

- School district (ISD)

- Municipal Utility District (MUD) – a subdivision or community

- County

- Community college

- Emergency Service District (ESD) – fire and emergency medical

- Farm-to-market road (FM/RD) – state roads and highways

- Water Control and Improvement District (WCID) – flood control and sewers

Each entity has its own tax rate and some offer exemptions for homestead property. We’ll cover homesteads and exemptions below.

In total, more than 4,100 local governments, school districts, cities, counties, and special districts (water districts, junior colleges, hospitals) collect property taxes in TX to pay for public services, water, police, fire, education, roads, etc.

Each local government determines the amount of property taxes it needs and sets its own tax rate. They often contract with their county’s tax assessor-collector to collect the tax on their behalf. The tax collector then distributes the money to schools, cities, and other local governments.(2)

To calculate tax rates, each entity estimates how much money they need. They then divide that amount by the total value of property they get to tax. To simplify this concept, let’s look at a made-up example.

Smallville – Property Tax Rate Example

Imagine a county called Smallville, with fifty homes, each worth $400,000. Smallville needs $200,000 each year to pay for government services and they have a school that costs $300,000 per year. So, their financial needs total $500,000.

Smallville:

- Total value of property: 50 homes x $400,000 = $20,000,000

- Amount of money needed to pay county and school bills: $200,000 + $300,000 = $500,000

- Tax rate to pay bills: $500,000/$20,000,000 = .025 or 2.5%

- Tax bill for each household: $400,000 x 2.5% = $10,000

So, each house in Smallville will get a property tax bill that says they owe $10,000. When all fifty households pay their $10,000 bill, the tax collector will have $500,000 (50 x $10,000), which is the amount needed to fund county services and the school.

In Texas, and across the U.S., homeowners receive a bill, each year, which shows their home value and a tax rate (for each entity that gets to tax them). The total of all line items is their annual property tax bill.

The tax amount is sometimes modified when the homeowner is a disabled veteran, a surviving spouse of a first responder who was killed, an old person, etc.

Property Tax Steps and Timeline

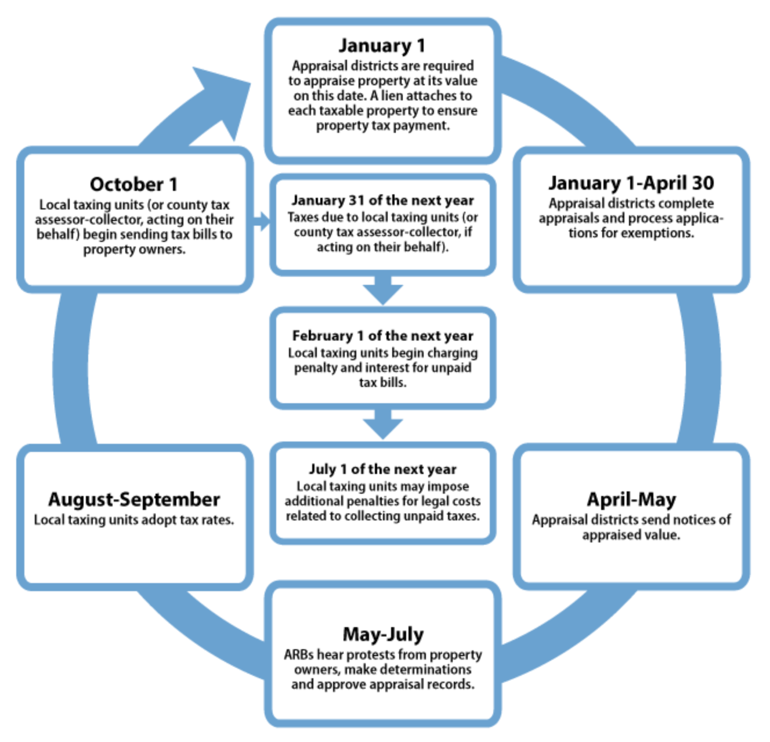

Residential property in Texas is appraised at the beginning of each year by county appraisal districts. Tax bills are sent out beginning October 1st and that year’s taxes are due January 31st of the following year.

Property tax rates are recalculated each year after appraisers re-evaluate all county property. Taxes are re-calculated based on total revenue needed.

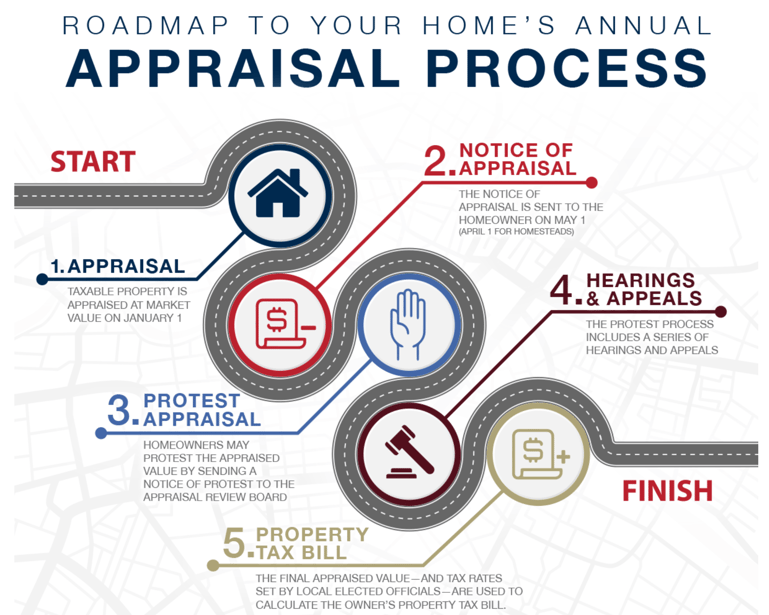

Notice all the steps that occur between January 1 through July are related to determining the value of all property in the county.(2) The graphic below shows the January through July appraisal process in more detail.(3)

Annual Appraisal Process Roadmap

Homestead

A homestead is sometimes referred to as a homestead exemption and it does two things:

1.) Provides a tax break for homeowner’s, on their principal residence, whether they live in a single-family house, condo, or manufactured home, on up to 20 acres of land that is used for residential purposes.(4)

2.) Is a legal provision that helps shield the homeowner from some creditors following the death of a homeowner’s spouse or a declaration of bankruptcy. Exemptions for homesteads vary by state. In Texas and Florida, the homestead provides unlimited financial protection of the equity in the house against unsecured creditors. This does not apply to secured creditors like mortgage companies who have a lien on the house.(5)

Homestead Exemptions

How does a homestead exemption reduce property taxes? Recall, property taxes are simply house value times tax rate. Exemptions, in effect, reduce the value of the house for tax calculation purposes for that taxing entity. This means the tax rate is multiplied by a smaller number (reduced house value), which lowers the taxes due.

What makes it confusing is that exemptions don’t apply across the board. Different taxing entities offer different exemptions. For example, the value reduction (exemption) for schools might be $40,000, but for Farms & Roads it may only be $3,000. If you’re confused, hold on… this will be clearer when we get to our real-life examples below.

Three tips:

- All homestead exemptions are filed with the appraisal district and there are no costs to file these forms. Disregard companies that offer to file these on your behalf for a fee

- A common misconception is that an owner must wait until the new year to apply for a homestead exemption. The appraisal district accepts homestead exemption applications year-round and they can be submitted online.

- Once a homestead is granted, exemptions do not need to be applied for again unless the Chief Appraiser requests an updated application.

Over Age 65

Independent School District (ISD) taxes freeze when owners file an OA65 exemption. Some other taxing units offer a freeze for those over 65. This means the net taxable value of the home does not go up each year after age 65, but only for certain taxing entities and unless the owner improves the property.

Some taxing entities, like the county, do not cap value at age 65, unfortunately.

Partial list of homestead exemptions offered in Texas:

- Over 65 Exemption – exempts an additional $10,000 of property value

- Over 65 Surviving Spouse

- Disabled Person

- Disabled Person Surviving Spouse

- 100% Disabled Veteran

- Surviving Spouse of a 100% Disabled Veteran

- Surviving Spouse of a Member of Armed Services Killed in Line of Duty

- Surviving Spouse of First Responder Killed

- Solar Exemption

- Heirship Homestead Exemption

Recent Good News

Effective January 1, 2024, a new law, went into effect that increases the amount of money a homeowner can deduct with a homestead exemption from the value of their primary residence from $40,000 to $100,000.*

Previously, Texas Proposition 1, the Property Tax Limit Reduction for Elderly and Disabled Residents Amendment, was approved by voters on May 7, 2022. This will give those with a 65+ or disabled exemption the same benefit others got in 2019 – basically, a small tax cut.

Texas Proposition 2 was approved May 7th. It was known as the Homestead Exemption for School District Property Taxes Amendment, and it increased the homestead exemption for school district property taxes from $25,000 to $40,000.

The increased exemption will take effect on 1/1/22 and will affect 2022 property taxes. For context, in 1997 the homestead exemption was raised from $5,000 to $15,000, and in 2015 it was raised from $15,000 to $25,000.

4 Common Mistakes

We started this article talking about how people panic in May when they receive their Notice of Appraised Value from the Appraisal District because they make four mistakes when estimating their property taxes for the year.

Mistake #1

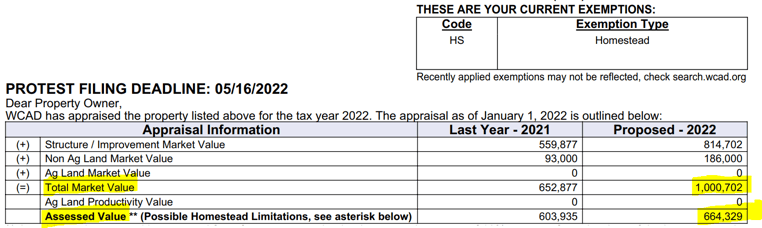

Mistake #1 is estimating taxes using Total Market Value instead of Assessed Value. When people multiply that new (eye-popping) Total Market Value by their tax rate they overestimate their taxes.

Imagine someone bought a home in 2018 for $565,000, their 2022 Total Market Value shows $1,000,702, and they think their tax rate is about 2.7%. They (erroneously) multiply $1,000,702 times 2.7% and come up with $27,018. Easy to empathize with them feeling like they have no choice but to sell because they cannot afford $2,251/mo. property taxes.

They also made a couple of other mistakes, which we’ll cover below.

Mistake #2

This mistake happens when people don’t understand how homestead exemptions reduce Assessed Value for certain tax entities, like schools, Farm & Road, etc., and how that lowers their tax bill. This will be clearer below in the real-life examples.

Mistake #3

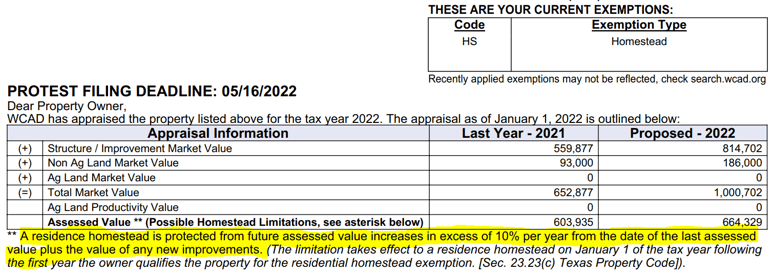

The third mistake people make is not understanding the Section 23.01, the 10% annual limit on increase on Assessed Value. Specifically, if a home’s market value goes up 20% in one year, the most the Assessed Value can increase is 10%.

TX Tax Code Section 23.01 requires taxable property to be appraised at market value as of January 1st. Tax Code Section 23.23(a) sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of the market value of the property or (property value last year + new improvements if any + 10% of last year’s value).(7) (8)

Improvements do not include repairs or ordinary maintenance. This 10% limit language is printed on the Notice of Appraised Value, but a lot of people miss it because they do not understand the form – see highlighted below.

Notice in the example above, if you multiply the 2021 Assessed Value by 1.1 (i.e., limiting the increase to 10%), you get $664,329 (603,935 x 1.1). Even though the value went up to $1,000,702, the 2022 Assessed Value of $664,329 will be used for tax purposes.

Mistake #4

The fourth and final mistake is not waiting until October to see what their property tax rates will be because tax rates may go down from the previous year. Wait, what?

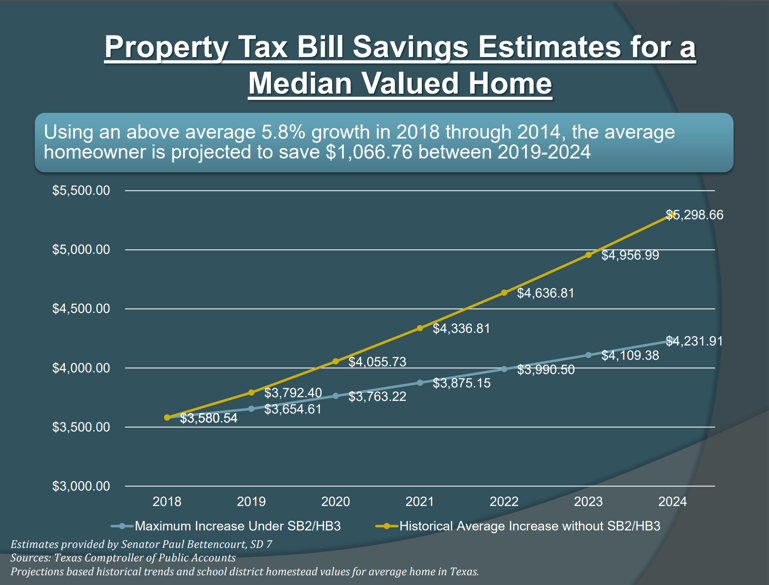

Few people know about Senate Bill 2, June 2019, which requires voter approval before local governments increase their property tax revenue by more than 3.5%. The new law took effect 1/1/20 and any increase larger than 3.5% triggers a referendum.(9) (10)

What it means is taxing entities (Independent School Districts, et al.) cannot raise their budgets (how much they say they need) by more than 3.5% without voter approval. When property values rise sharply, taxing entities must lower their tax rate for that year, or they’ll collect more money than they’re allowed to without voter approval.

The net effect of Senate Bill 2 is homeowners see a reduction in some tax rates, on a line-by-line, taxing entity basis, from one year to the next.(11) Notice the blue line in the chart below, which shows how much lower property taxes are because of Senate Bill 2.

Real-Life Property Tax Examples

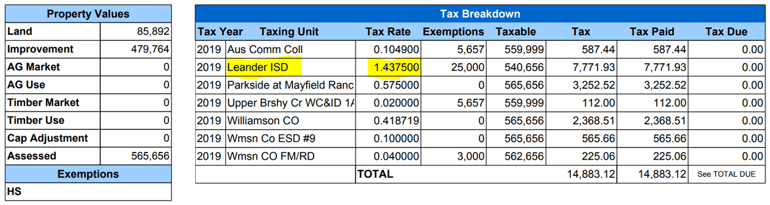

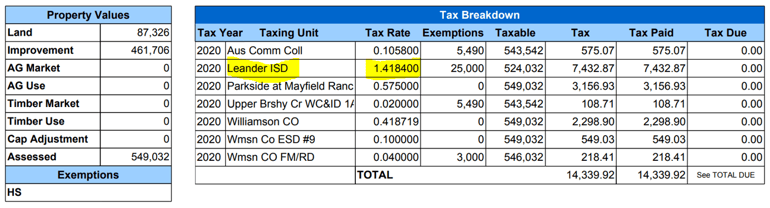

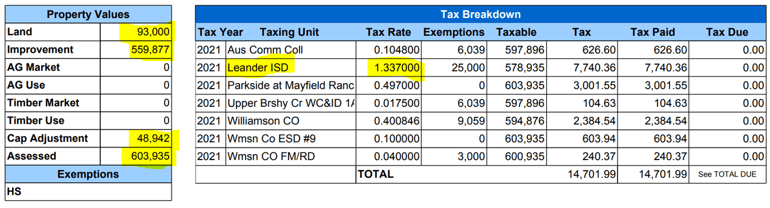

Below is an example showing the effect of Senate Bill 2. Notice that the Tax Rate for Leander ISD goes down each year:

- 2019: 1.4375

- 2020: 1.4184

- 2021: 1.337

2019

2020

2021

Notice in 2021, the Market Value was (93,000 + 559,877) 652,877, but the Assessed Value was $603,935. They are being taxed on 48,942 less than the Market Value. That is called a Cap Adjustment and is an example of TX Tax Code Section 23.01 discussed above.

Think about the implications of the 4 Common Mistakes. People unnecessarily panic in May because they incorrectly estimate how much they will have to pay. The reality is, even if the Assessed Value goes up by 10%, the tax bill may go up by 3.5%, instead of 10%.

The caps and tax relief noted above slows, but does not eliminate, the inevitable increase in property taxes that come from rising house prices.

Why Home Prices Keep Going Up

Texas, like much of the country, has experienced unbelievable home price appreciation. Since property taxes are based on home values, people are rightfully concerned that rising home prices will lead to significantly higher property taxes. Texans are not alone; the problem is nationwide and unprecedented.

The two main reasons home prices are high are:

- Supply vs. Demand - more buyers than homes

- Inflation

Supply vs. Demand

One reason there are more buyers than homes is because after the Great Recession, home builders built far fewer homes. Now that Millennials are moving out of their parents’ homes, the supply/demand imbalance is serious – especially in areas where young families are trying to buy, and high-paying jobs are plentiful, like Texas.

Inflation

We have not seen inflation like this in forty years. Why is it so high? Because the Federal Reserve printed and handed out $5 trillion in the last two years. The true rate of inflation is higher than government reported statistics, largely because they have changed the way they measure inflation.

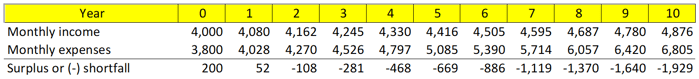

Sadly, most people are not factoring inflation into their retirement plans. Check out the example below:

- Homeowner has a $4,000 monthly income

- $3,800 in expenses

- They get annual cost of living adjustment increases of 2%

- But their expenses go up each year by 6%

This homeowner is okay today, their $4,000 monthly income is more than their $3,800 monthly expenses.

However, if their expenses increase 6% per year while their income only goes up 2% each year, by year three they are underwater and by year ten they are short almost $2,000 per month. Property taxes are just part of the increased expenses.

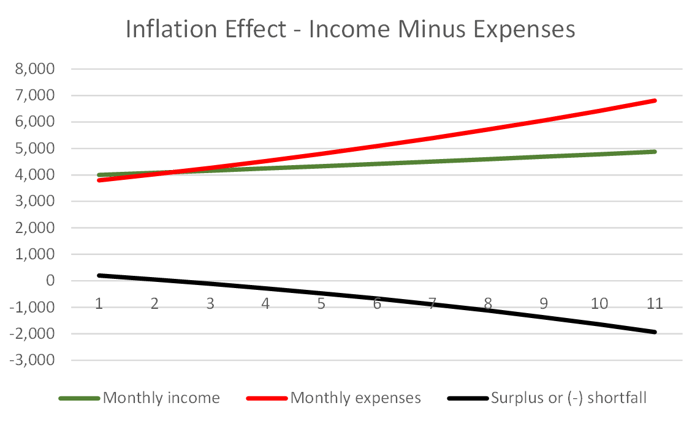

Texas Property Taxes

The state of Texas does not charge property tax or income taxes. Property taxes are only levied (charged) at the county and city level.

County/city property taxes in Texas rank around 6th or 7th in the country for property taxes as a percentage of house value, averaging between 1.74% to 1.8%. , compared to the national average of 1.13%.(13)

States with the higher property tax rates than Texas:

- New Jersey – 2.37%

- Illinois – 1.93%

- New Hampshire – 2.09%

- Connecticut – 2.12%

- Vermont – 1.9%

Californians, for example, don’t have these property tax issues because of their Proposition 13, which locks home values close to the initial purchase price. Their effective property tax rate is around 0.71%.*

That may not last forever. A recent article in Cal Matters (purportedly a nonprofit, nonpartisan state news site) notes Prop. 13 has been criticized by policy experts for effectively offering long-time homeowners hefty tax discounts relative to new buyers. The title of the article was Prop. 13 offers bigger tax breaks to homeowners in wealthy, white neighborhoods. It's anybody's guess how California will address their 2024-2025 $68 billion deficit. Certainly Millennials and Gen-Z buyers cannot be happy paying 2-, 3-, or 4-times more than older homeowners who have a view of the ocean.

When discussing taxes, it is important to look at the whole tax picture, not just property taxes, but also state and local income taxes, sales taxes, registration fee, etc. The state individual income tax rate in Texas is zero.(14)

We have heard stories from people, who moved from a high-cost state to Texas or Florida, say the money they saved by not paying state income tax more than covers their mortgage payment, property taxes, home insurance, and HOA dues. They claim they are living in their home for free.

This relocation benefit does not apply to seniors who are retired and move from high-cost states because their earned income is low. The lack of state income tax only helps them if they have side income (consulting) and/or large required minimum distributions (RMDs) from their IRAs.

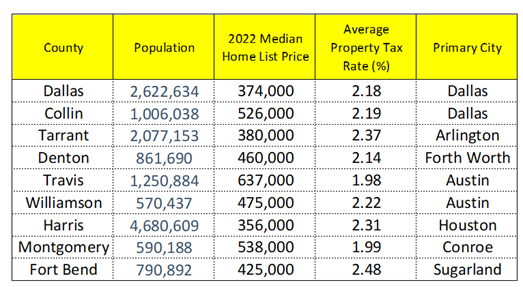

Texas Counties

There is a saying that all real estate is local. While the state of Texas has average property taxes of 1.8%, here is a summary of major Texas counties, from north to south.

For an excellent graphic on Central Texas property tax rates and exemptions from 2023, check out this great resource from Stewart Title: Central Texas Tax Rates by County.

The easiest and best way to calculate a specific property's tax rate, and see how exemptions affect the tax bill, is to go to that county’s online property tax estimator. See links provided below for major Texas counties.

County Online Property Tax Estimators

Click county below:

Solutions For High Property Taxes

Hopefully, you now have a better understanding of How Property Taxes Work, the 4 Common Mistakes people make when estimating their tax bill, and why house prices are going up so much.

Whether you’re looking at your own situation, or helping a friend or a parent, the question remains, “What are we going to do about these ever-increasing property taxes?”

Property Tax Deferral

Many people do not know that if a homeowner is age 65 or older (OA65), a disabled person (DP), or a disabled veteran (DV), and the property is their residence homestead, they may qualify to postpone paying current or delinquent property taxes by signing a residence homestead tax deferral.

Unpaid taxes will accumulate with 5% interest per year for each tax year that is due. To learn more, click here. And to see an example of a Tax Deferral form, click here.(15) (16)

Caution: if the home is not paid off, i.e., there is a mortgage on the house, the lender may not allow a property tax deferral. You will want to check with them before applying. Or there may be another, better option.

Resources | References

(*) Portions of this post were updated on 5/20/24.

(1) The Basics, Property Taxes Made Simple, Texas Realtors - https://knowyourtaxes.org/the-basics/

(2) Property Tax System Basics, Texas Comptroller - https://comptroller.texas.gov/taxes/property-tax/basics.php

(3) The Appraisal Process, Texas Realtors - https://knowyourtaxes.org/appraisal-process/

(4) Taxes, Residence Homestead Exemptions FAQs, Texas Comptroller - https://comptroller.texas.gov/taxes/property-tax/exemptions/residence-faq.php

(5) Homestead Exemption, Investopedia - https://www.investopedia.com/terms/h/homestead-exemption.asp

(6) New Homestead Exemption Law Benefits Some Residential Purchasers, Texas Realtors - https://www.texasrealestate.com/members/posts/new-homestead-exemption-law-benefits-residential-purchasers/

(7) Taxes – Valuing Property, Texas Comptroller - https://comptroller.texas.gov/taxes/property-tax/valuing-property.php

(8) Texas Tax Code - TAX § 23.23. Limitation on Appraised Value of Residence Homestead, FindLaw, 4/14/21 - https://codes.findlaw.com/tx/tax-code/tax-sect-23-23.html

(9) Property Tax Process Post-Senate Bill 2 (2019), 7/14/21, TML Staff - www.tml.org/DocumentCenter/View/1485/sb-2-qa_update_july-2021?bidId=

(10) What’s Changed After Senate Bill 2?, Texas Realtors https://knowyourtaxes.org/Whats-Changed-after-SB-2.pdf

(11) Senate Bill 2 Texas Property Tax Reform and Transparency Act of 2019, Texas Senate - https://senate.texas.gov/members/d07/press/en/p20190719a.pdf

(12) U.S. Home Price Insights, CoreLogic, 5/3/22 - https://www.corelogic.com/intelligence/u-s-home-price-insights/

(13) Property Taxes by State, WalletHub, 3/2/22, John S Kiernan - https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585

(14) State Individual Income Tax Rates and Brackets for 2022, Tax Foundation, 2/15/22, Timothy Vermeer and Katherine Loughead - https://taxfoundation.org/publications/state-individual-income-tax-rates-and-brackets/

(15) Over 65-Disabled Person-Disabled Veteran-Tax Deferral, Williamson County, Texas - https://www.wilco.org/Elected-Officials/Tax-Assessor-Collector/Property-Tax/Over-65-Disabled-Person-Disabled-Veteran-Tax-Deferral

(16) Tax Deferral Affidavit for 65 or Over or Disabled Homeowner Form 50-126, Travis County - https://tax-office.traviscountytx.gov/files/properties/tax-deferral-affidavit.pdf

(17) Austin Local Guides, Stewart Title - https: www.stewartaustinmarketing.com/local-area-information

(18) The 2024-25 Budget: California's Fiscal Outlook: https://lao.ca.gov/reports/2023/4819/2024-25-Fiscal-Outlook-120723.pdf

.png?width=161&height=74&name=considering%20AUSTIN%20(1).png)